HomeEquity Bank Listed on the 2016 PROFIT 500

TORONTO, Sept. 15, 2016 /CNW/ - Canadian Business and PROFIT today placed HomeEquity Bank on the 28th annual PROFIT 500, the definitive ranking of Canada's Fastest-Growing Companies. Published in the October issue of Canadian Business and at PROFITguide.com, the PROFIT 500 ranks Canadian businesses by their five-year revenue growth. HomeEquity Bank, the only national provider of reverse mortgages in Canada, placed 475 on the 2016 PROFIT 500 list, thanks to a five-year revenue growth of 80%. The company's total revenu

Continue Reading...

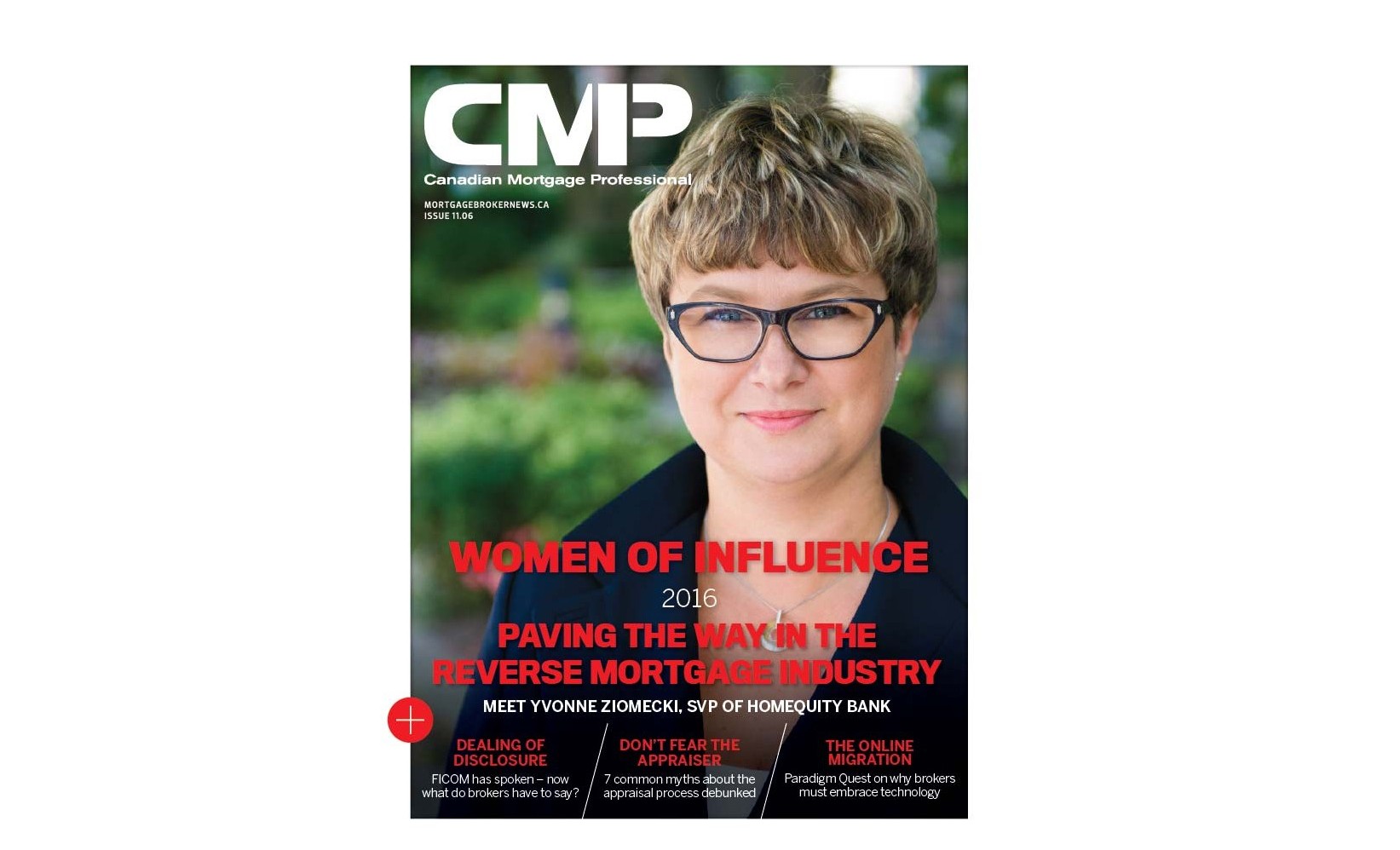

Yvonne Ziomecki named one of CMP Magazine’s Women of Influence

TORONTO, July 6, 2016 – HomeEquity Bank is pleased to announce that Yvonne Ziomecki, SVP, Marketing & Sales is named one of Canadian Mortgage Professional (CMP) Magazine’s Women of Influence. In the issue out on stands now, Yvonne credits the power of a strong network and support system as her secret to consistent results and her coveted work-life balance. “Balancing work with personal life, especially the needs of my children and finding time for myself, it’s not always easy. Having a strong network is key.

Continue Reading...

HomeEquity Bank announces partnership with Kurt Browning

TORONTO, June 22, 2016 /CNW/ - HomeEquity Bank, the only Canadian bank working exclusively with seniors, is proud to announce its new spokesperson is Canadian figure skating icon Kurt Browning. Kurt Browning is a Canadian figure skater, choreographer and commentator. He is a four-time World Champion and four-time Canadian national champion. "We're thrilled to be partnering with Kurt," said Yvonne Ziomecki, SVP, Marketing & Sales at HomeEquity Bank. "It was important to us to work with someone Canadians view as tru

Continue Reading...

HomeEquity Bank launches Mortgage Broker Direct

TORONTO, Sept. 14, 2015 - HomeEquity Bank launches its new “Mortgage Broker Direct (MBD)” program this week. For the first time, mortgage brokers will be able to submit deals directly to the bank via D+H Expert upon being certified. Last year, HomeEquity Bank’s broker business saw a growth of 39%, with over 1,000 mortgage brokers sending in referrals with an average deal size of $150,000. The Mortgage Broker Direct program through HomeEquity Bank will offer a no-fee certification process to a limited number of mortg

Continue Reading...

HomeEquity Bank 2015 Retirement Study

In a first-of-its-kind study HomeEquity Bank has asked Canadians about their hopes and plans for retirement.The goal is to compare Canadians’ financial expectations for retirement with their financial reality once they finish working. Download the complete report View the full infographics: [gallery link="file" ids="661,660,659"]

Continue Reading...

Canadians Over 75: Financially Stable, Well-Connected and Ready for More, But Folks in their 50s not so sure

TORONTO, ON (October 1, 2024) – A new survey commissioned by HomeEquity Bank reveals Canadian homeowners aged 75 and older are outshining their younger counterparts on key happiness markers, offering an insightful guide for younger generations entering a new life stage. According to the survey, 95 per cent of Canadians 75 and older are very satisfied or somewhat satisfied with their lives, compared to just 79 per cent of Canadians in their 50s. "Our purpose is to empower Canadian homeowners 55+ to have the freedom to

Continue Reading...

The Globe and Mail Names HomeEquity Bank in its Ranking of Canada’s Top Growing Companies for a Fourth Time

Toronto, ON, September 27, 2024 – HomeEquity Bank, provider of the CHIP Reverse Mortgage, is pleased to announce it has been recognized in the Report on Business ranking of Canada’s Top Growing Companies for the fourth time. Assessed on three-year revenue growth, HomeEquity Bank earned its spot after reporting over $1 billion in reverse mortgage originations for the third consecutive year. The value of the Bank’s total reverse mortgage portfolio under management stood at $7.4 billion as of December 2023, further cem

Continue Reading...

New HomeEquity Bank CEO to Continue Customer-Centric Growth

Industry veteran Katherine Dudtschak becomes President and CEO TORONTO, July 2, 2024 – HomeEquity Bank, provider of the CHIP Reverse Mortgage, is pleased to welcome Katherine Dudtschak as its new CEO. Ms. Dudtschak joined the Bank as President on May 1 following the announcement that former President and CEO Steven Ranson planned to retire at the end of June. As President and CEO, Ms. Dudtschak has officially assumed leadership of the federally regulated Schedule 1 Bank, overseeing its strategic vision for customer

Continue Reading...

“It’s a Bittersweet Symphony” for the Sandwich Generation: New Ipsos survey exposes the struggles and sacrifices of aging in place.

Sandwich Generation balances the impact of parents aging in place with their own career progression and financial future Professional financial planning and Personal Support Workers seen as key to Canadians staying in the homes they love HomeEquity Bank names 2024 Home Care Heroes Award winners, recognizing the importance of exceptional caregivers for Personal Support Worker Day on May 19 TORONTO, May 14, 2024 – HomeEquity Bank, provider of the CHIP Reverse Mortgage, worked with Ipsos on new research t

Continue Reading...

HomeEquity Bank President and CEO Steven Ranson to retire June 30, 2024, after 27 successful years leading the bank

Industry veteran Katherine (Katie) Dudtschak appointed HomeEquity Bank’s next President and CEO TORONTO, April 9, 2024 — HomeEquity Bank announced today that Steven Ranson will be retiring as President and CEO after a remarkable 27-year career building the reverse mortgage industry in Canada and establishing HomeEquity Bank as the market leader. HomeEquity Bank’s Board of Directors has appointed Katherine (Katie) Dudtschak as the bank’s next President and CEO. During Mr. Ranson’s leadership

Continue Reading...