HomeEquity Bank Listed on the 2016 PROFIT 500

TORONTO, Sept. 15, 2016 /CNW/ - Canadian Business and PROFIT today placed HomeEquity Bank on the 28th annual PROFIT 500, the definitive ranking of Canada's Fastest-Growing Companies. Published in the October issue of Canadian Business and at PROFITguide.com, the PROFIT 500 ranks Canadian businesses by their five-year revenue growth. HomeEquity Bank, the only national provider of reverse mortgages in Canada, placed 475 on the 2016 PROFIT 500 list, thanks to a five-year revenue growth of 80%. The company's total revenu

Continue Reading...

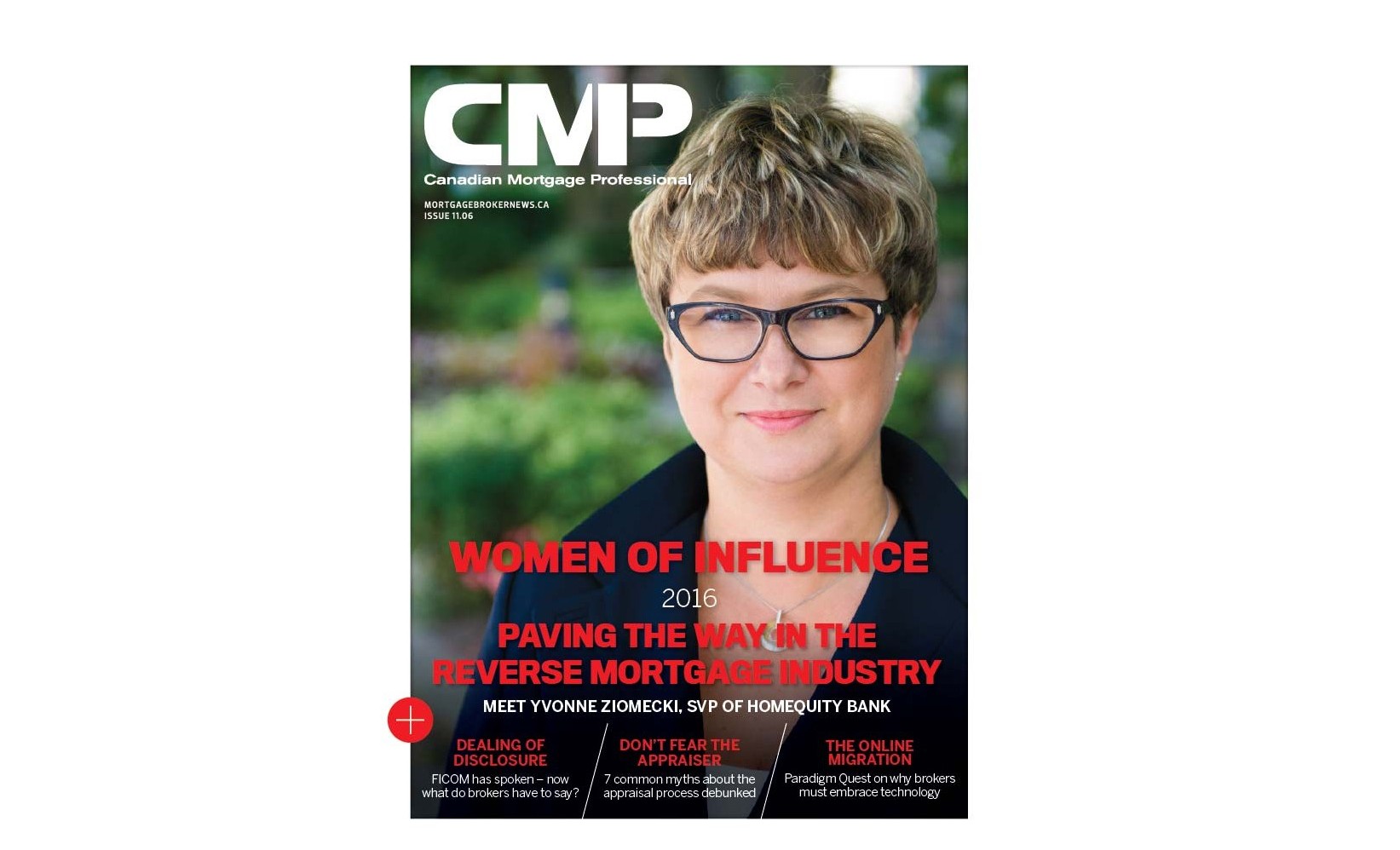

Yvonne Ziomecki named one of CMP Magazine’s Women of Influence

TORONTO, July 6, 2016 – HomeEquity Bank is pleased to announce that Yvonne Ziomecki, SVP, Marketing & Sales is named one of Canadian Mortgage Professional (CMP) Magazine’s Women of Influence. In the issue out on stands now, Yvonne credits the power of a strong network and support system as her secret to consistent results and her coveted work-life balance. “Balancing work with personal life, especially the needs of my children and finding time for myself, it’s not always easy. Having a strong network is key.

Continue Reading...

HomeEquity Bank announces partnership with Kurt Browning

TORONTO, June 22, 2016 /CNW/ - HomeEquity Bank, the only Canadian bank working exclusively with seniors, is proud to announce its new spokesperson is Canadian figure skating icon Kurt Browning. Kurt Browning is a Canadian figure skater, choreographer and commentator. He is a four-time World Champion and four-time Canadian national champion. "We're thrilled to be partnering with Kurt," said Yvonne Ziomecki, SVP, Marketing & Sales at HomeEquity Bank. "It was important to us to work with someone Canadians view as tru

Continue Reading...

HomeEquity Bank launches Mortgage Broker Direct

TORONTO, Sept. 14, 2015 - HomeEquity Bank launches its new “Mortgage Broker Direct (MBD)” program this week. For the first time, mortgage brokers will be able to submit deals directly to the bank via D+H Expert upon being certified. Last year, HomeEquity Bank’s broker business saw a growth of 39%, with over 1,000 mortgage brokers sending in referrals with an average deal size of $150,000. The Mortgage Broker Direct program through HomeEquity Bank will offer a no-fee certification process to a limited number of mortg

Continue Reading...

HomeEquity Bank 2015 Retirement Study

In a first-of-its-kind study HomeEquity Bank has asked Canadians about their hopes and plans for retirement.The goal is to compare Canadians’ financial expectations for retirement with their financial reality once they finish working. Download the complete report View the full infographics: [gallery link="file" ids="661,660,659"]

Continue Reading...

“By Canadian” Book Club throws the book at U.S. tariff threats

HomeEquity Bank throws its CHIPs in on “Buy Canadian” movement: offers free books to customers written by notable Canadian authors CHIP Reverse Mortgage clients are invited to muzzle tariff uncertainty with a relaxing read TORONTO – February 27, 2025 – On February 27th, HomeEquity Bank, provider of the CHIP Reverse Mortgage, launched a By Canadian Book Club, offering its customers free books from a curated collection of Canadian authors including Peter Mansbridge. Created as an answer to the growing desire

Continue Reading...

HomeEquity Bank joins the National Institute on Ageing’s First Pension Centre of Excellence

NIA launches new centre to drive innovation in retirement income security Toronto, ON (February 19, 2025) – HomeEquity Bank is proud to join the National Institute on Ageing’s (NIA) Pension Centre of Excellence (PCE) as an inaugural member. HomeEquity Bank is committed to supporting Canadians age 55 and better in addressing gaps in Canada’s retirement income system. Joining the PCE is an opportunity to work with partners across the industry in a world-class, non-partisan, research-informed, and action-orienta

Continue Reading...

2025 predictions: Five ways Canadians 55+ will impact all generations

Canadians 55+ are responding to changing cost of living and housing prices by swapping inheritances for shared experiences and timely financial aid for their younger loved ones TORONTO, ON (January 2, 2025) – This year, older Canadians will throw out the traditional retirement playbook and embrace new financial, technological and familial norms to live more independent and enriching lives. Insights like this from HomeEquity Bank and Ipsos reveal five key predictions for Canadians aged 55+ that will have ripple ef

Continue Reading...

Tipping point: New Survey Finds More Canadians Have Seen a YouTube Video About the World Wars Than Have Met a Veteran of Those Wars

“Meeting with the Past” Remembrance Day Campaign Offers a New Way to Connect with Veterans’ Stories and Donate to Support Veterans [embed]https://youtu.be/5IKrbAHgZVQ[/embed] Meeting With The Past 30-second national broadcast spot | An invitation to experience a week of wartime as a reminder of the sacrifices of our Veterans. [embed]https://youtu.be/EQfszWYhjN4[/embed] Meeting With The Past explainer video | Join the meeting and explore the lives of soldiers during wartime. Honour their sacrifice with a

Continue Reading...

Canadians Over 75: Financially Stable, Well-Connected and Ready for More, But Folks in their 50s not so sure

TORONTO, ON (October 1, 2024) – A new survey commissioned by HomeEquity Bank reveals Canadian homeowners aged 75 and older are outshining their younger counterparts on key happiness markers, offering an insightful guide for younger generations entering a new life stage. According to the survey, 95 per cent of Canadians 75 and older are very satisfied or somewhat satisfied with their lives, compared to just 79 per cent of Canadians in their 50s. "Our purpose is to empower Canadian homeowners 55+ to have the freedom to

Continue Reading...