Gifting with ‘warm hands’ one way parents help children financially

HomeEquity Bank notes rising trend during Holiday Season TORONTO, Dec. 15, 2014 /CNW/ - With the holiday season fast approaching some may find it more special than ever, as aging Canadians embrace the concept of 'giving with warm hands'. That's according to HomeEquity Bank, which states that almost 5% of clients aged 55 and over arrange reverse mortgages as a way to gift money to their adult children. "What we hear from some of our clients is that they want to see their loved ones enjoying the results of their hard

Continue Reading...

10 Facts That Will Make You Change Your Mind on Reverse Mortgages

HomeEquity Bank sets the record straight TORONTO, Nov. 24, 2014 /CNW/ - There's a lack of information around reverse mortgages, and as more seniors look to this type of financing to help their adult children as well as finance their retirement - it's time to set the record straight on some misconceptions. That's according to HomeEquity Bank, a Schedule 1 Canadian Bank offering the CHIP (www.chip.ca) reverse mortgage. Here, below, are the bank's 'Top 10 Facts That Will Make You Change Your Mind on Reverse Mortgages': 1) O

Continue Reading...

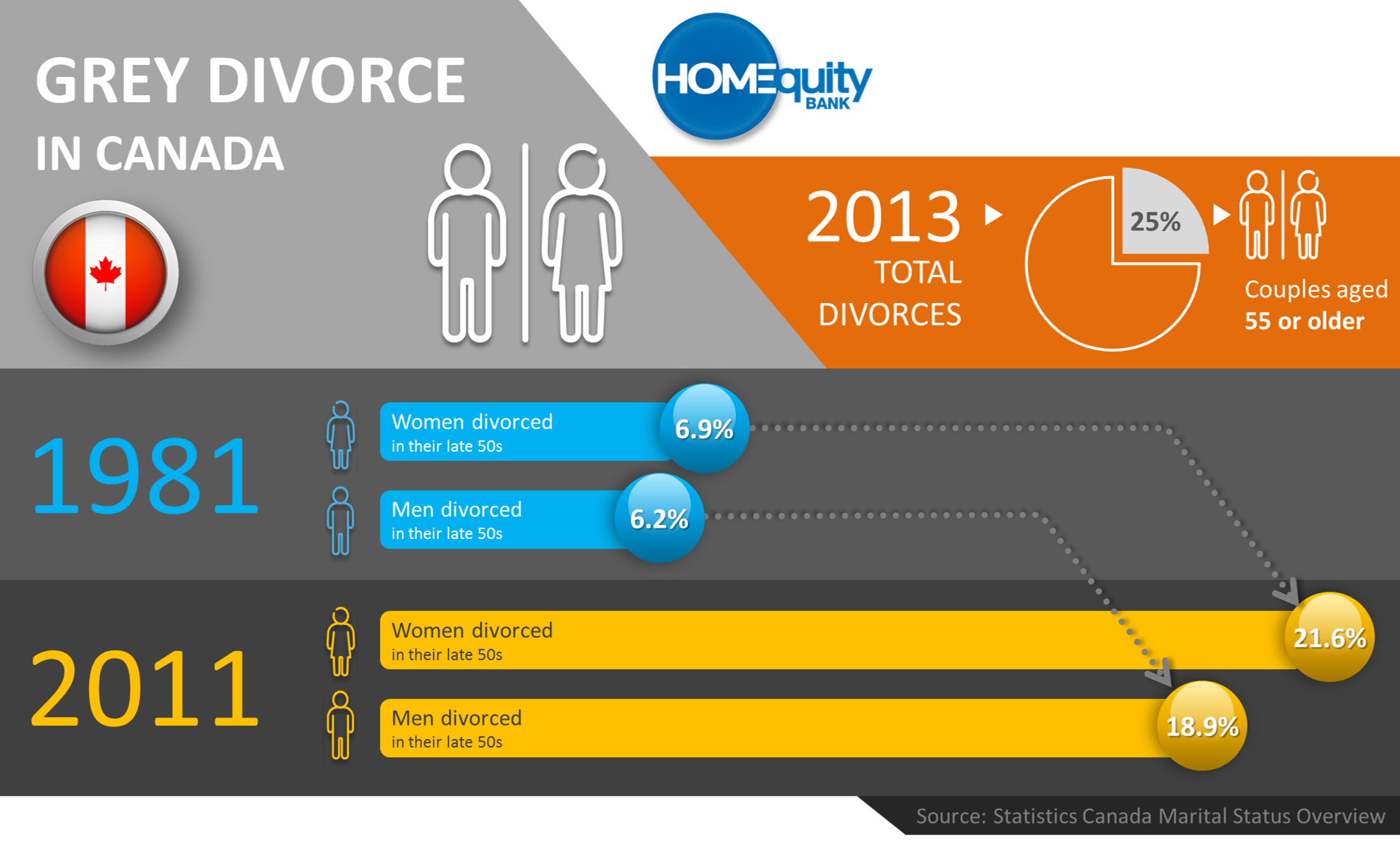

Boomers: how will you finance your ‘grey’ divorce?

The cost of maintaining 2 homes greatly increases expenses in retirement TORONTO, Oct. 27, 2014 /CNW/ - With the number of grey divorces on the rise in Canada, many Boomers may not realize the cost of maintaining two homes can increase expenses by as much as $20-$30,000 per year. This can have a serious impact on finances during retirement. In fact, according to Statistics Canada 2011 census data, divorce among Baby Boomers is becoming more common and the numbers are expected to steadily increase. Approximately 60,000

Continue Reading...

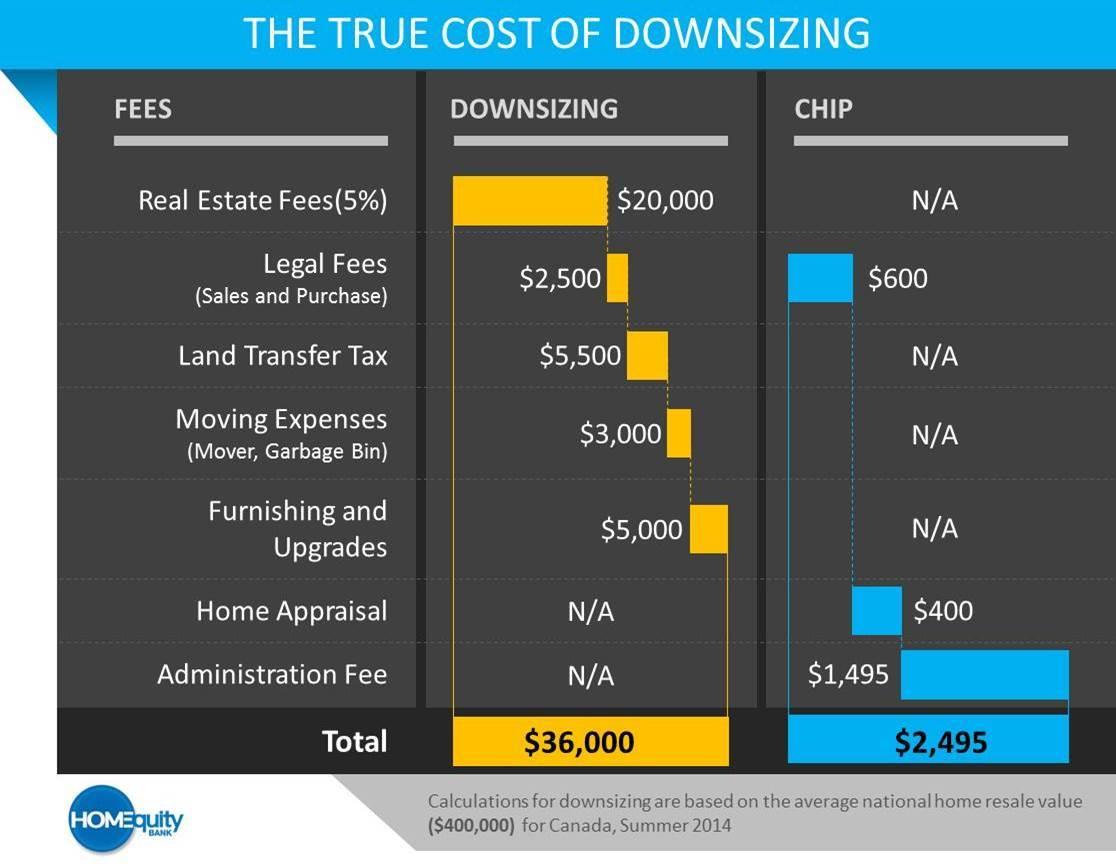

Seniors: ready to spend a minimum of $40,000?

Emotional, financial costs should both be considered TORONTO, Sept. 23, 2014 /CNW/ - When it comes to retirement, many Canadians look to downsizing to a smaller home or condo to supplement income for their latter years. What many fail to realize, however, is the average cost of downsizing is approximately $40,000. That's according to mortgage agent John Cavan, a 26-year industry expert with Mortgage Architects. The cost is an industry average based on the sale of a $400,000 home and includes real estate, legal and movi

Continue Reading...

Guess what women seniors worry about most?

Yes, it's money and the fear of running out of funds in retirement TORONTO, July 22, 2014 /CNW/ - Although retirement is meant to be a time to enjoy friends and family it's finances that typically derail what can be a special time – especially for women seniors. That's because this segment of Canada's population was raised in a time when most men were expected to control the finances, explains Trevor Van Nest, Owner and Founder of York Region Money Coaches. "And then, in their later years, many of these women find

Continue Reading...