Surprise! Boomers are no more likely to have been victimized by online fraud or scams despite being targeted more frequently

• Survey reveals 66% of Canadians think Boomers are the most likely scam victims

• Data shows Boomers are actually among the most vigilant when it comes to engaging in higher risk online behaviours.

• Older Canadians continue to be highly targeted by scammers, driving the need for education to help stay one step ahead

• Are you unscammable? Quiz offers Canadians a chance to test their mettle on fraud

TORONTO – March 1, 2024 – It’s a tired punchline: older people fall victim to scammers because they’re less tech savvy and more susceptible to being tricked. A new survey from Ipsos and HomeEquity Bank, provider of the CHIP Reverse Mortgage, further disproves that outdated notion. In fact, Boomers are no more likely to have been victimized by online fraud or scams than any other generation. Its findings show that not only is this demographic more vigilant than other generations about online safety, the born-online generations are the ones opening themselves up to scams the most by engaging in risky online behaviour. Despite this truth, two thirds (66%) of Canadians polled think Boomers are the most likely to fall victim to online scams.

“Our bank only works with Canadian homeowners 55+ so we have a pretty good read on just how capable and savvy these folks are, and this study confirmed our own research,” said Vivianne Gauci, Senior Vice President Customer Experience , HomeEquity Bank. “Our customers are often the ones being the most careful with technology. But even if they aren’t falling for scams, older Canadians are highly targeted by ever-more sophisticated scammers. We want to help them fight back against the stereotype and the scammers by providing them with even more education to help keep their scam-sense sharp.”

Whose scam is it, anyway?

Survey data reveals Canadians across generations are divided in their opinions of who is a likely target for scams and for what reason.

“Our findings suggest that the younger the demographic, the more likely they are to be engaging in risky behaviour—like the familiarity creates a false sense of security.” said Gauci. “It’s not just because they’re using technology more. It’s things like connecting to public Wi-Fi, using autofill for passwords or the same one for multiple accounts.”

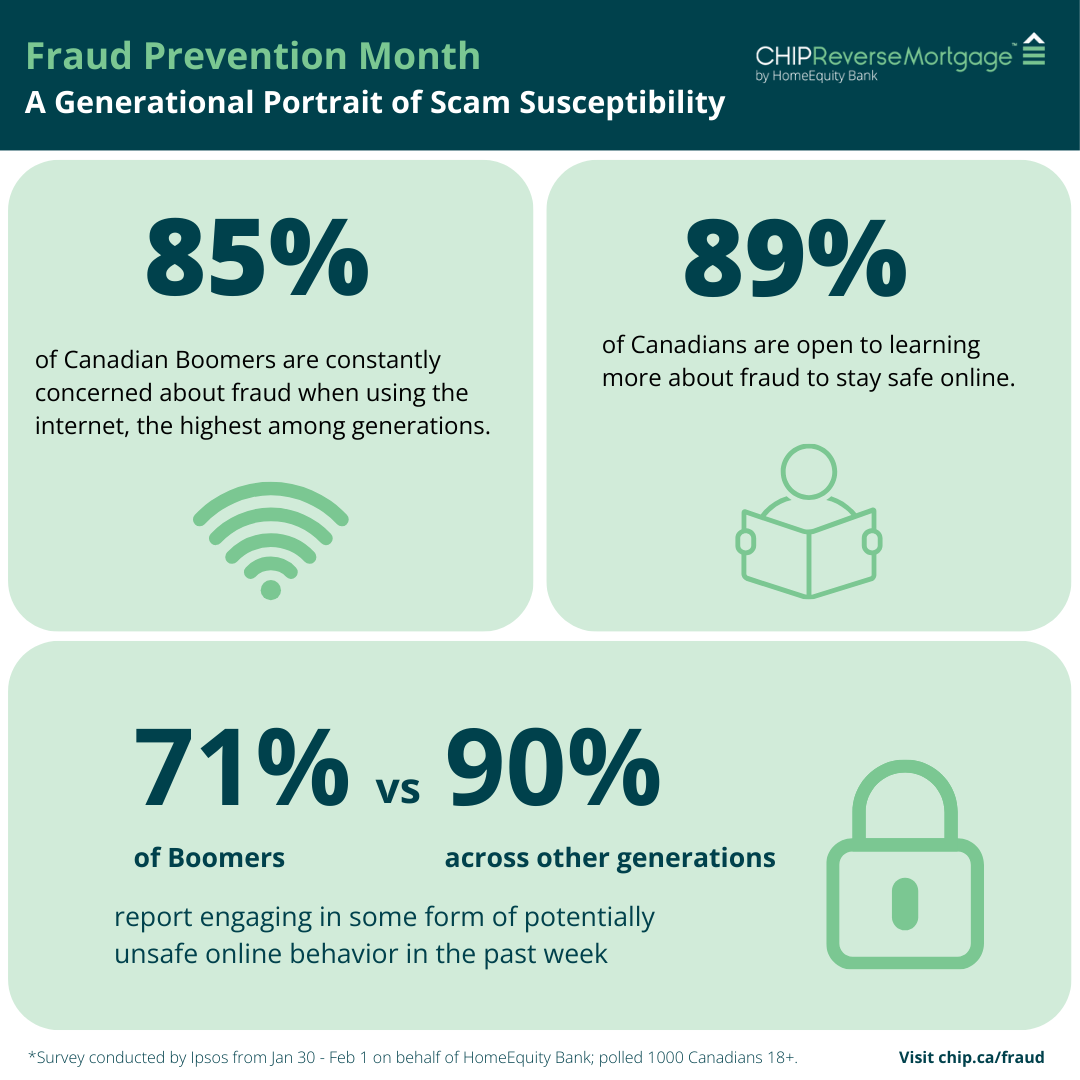

Boomers lead all other demographics when it comes to being constantly concerned about fraud when using the internet at 85% versus a 76% average for all other generations. This isn’t surprising, as past data suggests they’re highly targeted.

The good news is they’re not falling for it and are least likely to engage in unsafe behaviour. While a majority of Canadians (84%) report engaging in some form of potentially unsafe online behaviour within the past week, Boomers are least likely to have done so (71% vs. 90% across all other generations).

“It’s satisfying to have data reinforce what I know to be true about people over 55 when it comes to being safe online. Confidence is important, but it’s just as important to stay informed with new types of scams popping up every day,” said Bill VanGorder, Chief Policy and Education Officer, Canadian Association for Retired Persons (CARP). “I urge retirees to continually refresh their knowledge of safe online behaviour because this demographic will continue to be perceived as a prime target, as these new survey results suggest.”

What remains consistent across demographics is that Canadians are open to learning more about fraud and staying safe online (89%). Collectively, there’s concern about new AI technologies (83%), and a desire for more education on cybersecurity for data protection (77%).

HomeEquity Bank is committed to providing resources to help its clients and all Canadians stay ahead of fraud. Anyone who wants to test their scam-sense is invited to take the Unscammable quiz or check out fraud prevention resources at chip.ca/fraud.

About HomeEquity Bank

HomeEquity Bank is a Schedule 1 Canadian Bank offering a range of reverse mortgage solutions including the flagship CHIP Reverse Mortgage™ product. The company was founded more than 35 years ago to address the financial needs of Canadians who wanted to access the equity of their top asset – their home. The Bank is committed to empowering Canadians aged 55 plus to live the retirement they deserve, in the home they love. HomeEquity Bank is a portfolio company of Ontario Teachers’ Pension Plan Board, a global investor that delivers retirement income for 336,000 current and retired teachers in Ontario. For more information, visit www.chip.ca.

For further information:

| HomeEquity Bank | Weber Shandwick for HomeEquity Bank |

| Vivianne Gauci, SVP Customer Experience and Chief Marketing Officer | Adam Bornstein |

| Phone: (416) 413-4661 | Phone: (905) 505-2540 |

| Email: vgauci@heb.ca | Email: abornstein@webershandwick.com |