HomeEquity Bank President and CEO Steven Ranson to retire June 30, 2024, after 27 successful years leading the bank

Industry veteran Katherine (Katie) Dudtschak appointed HomeEquity Bank’s next President and CEO

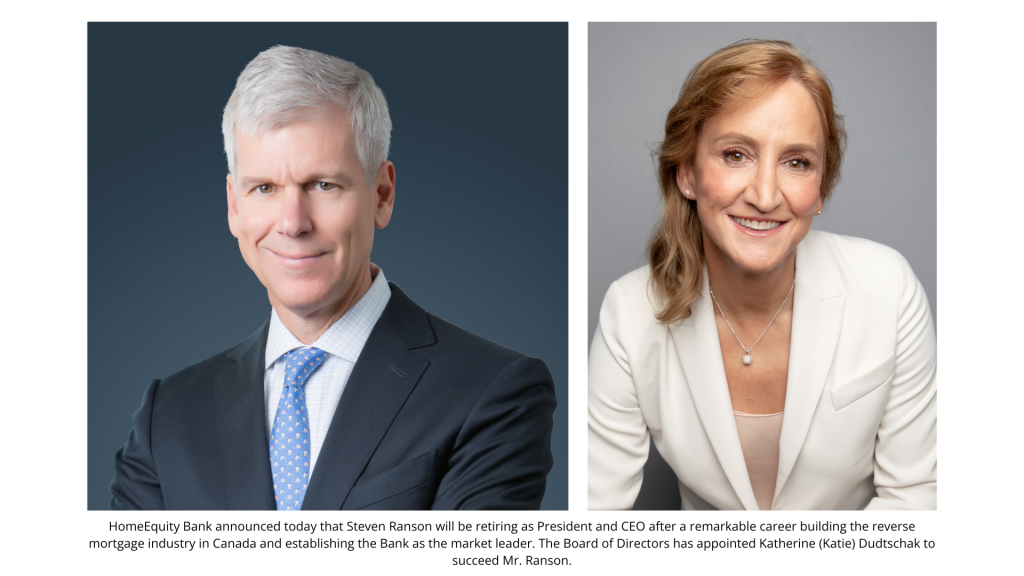

TORONTO, April 9, 2024 — HomeEquity Bank announced today that Steven Ranson will be retiring as President and CEO after a remarkable 27-year career building the reverse mortgage industry in Canada and establishing HomeEquity Bank as the market leader. HomeEquity Bank’s Board of Directors has appointed Katherine (Katie) Dudtschak as the bank’s next President and CEO.

During Mr. Ranson’s leadership tenure, HomeEquity has undergone significant growth. When he joined the bank in 1997, the company had 36 employees and $100 million of total mortgages. Today the bank has over 300 employees, a portfolio of almost $8 billion, and has originated over $1 billion of new mortgages in each of the past three years. Under his leadership, HomeEquity Bank has helped over 70,000 older Canadians to enjoy a more rewarding retirement and the company has been recognized as one of Canada’s Most Admired Corporate Cultures by Waterstone Human Capital.

On his decision to retire, Mr. Ranson said, “We have achieved what I set out to achieve many years ago; to establish reverse mortgages and HomeEquity Bank as a respected choice for older Canadians. I feel confident that this is the right time to pass the torch to a new leader who will continue to build on our long track record of success.”

Daniel Jauernig, Chair of the Board of HomeEquity Bank said, “It’s been an honour working with Steve these past 27 years as he built HomeEquity Bank into the leading national provider of reverse mortgages in Canada. He is a committed and passionate leader, focused on customer satisfaction and employee engagement. We thank him for his many contributions over the years that have positioned the bank for continued growth and success. I wish him all the best in his retirement and future endeavors.”

Jeff Markusson, Senior Managing Director, Financial Services at Ontario Teachers’ Pension Plan and a member of the Board of HomeEquity Bank added, “We are pleased to congratulate Steve on his retirement. He is a true leader in Canadian financial services, and has made a compelling and meaningful contribution to the growth of HomeEquity Bank. We are proud to have been able to partner with him.”

Industry veteran Katherine (Katie) Dudtschak will become the bank’s new President and CEO

HomeEquity Bank’s Board of Directors is pleased to appoint Ms. Dudtschak as the bank’s next leader. She is a highly respected and experienced senior executive who brings deep skills and personal and commercial banking experience. Most recently she held the position of Executive Vice-President, Regional Banking at RBC, where she led a team of over 25,000 advisors and co-led the development of RBC’s omni-channel distribution strategy. Ms. Dudtschak also held the position of CEO of RBC’s Caribbean bank, overseeing operations in 19 countries where she successfully led the repositioning of the business and achieved strong and sustained profitability and growth.

Welcoming Ms. Dudtschak, Mr. Markusson said, “We are delighted to welcome Katie to HomeEquity Bank. She brings a compelling range of skills and financial services experiences, and we are excited to see the impact she can have on HomeEquity Bank’s mission to help Canadians aged 55+ to live a more comfortable retirement.”

Ms. Dudtschak said, “I am honoured and incredibly proud to be joining the HomeEquity Bank team. Congratulations Steve on all you have given and achieved. HomeEquity Bank is a very special organization that addresses an important and growing need in our society. I look forward to being part of leading and building the bank for the future.”

Ms. Dudtschak is known inside and outside the financial services industry for her strategic, collaborative, and purpose-driven leadership approach. She is widely recognized as a leader in Diversity, Equity and Inclusion, having been recognized by Catalyst Canada with the business leaders’ Honours Award and by CGLCC with the Legacy Award.

She is a tireless community builder, having invested her volunteer efforts in the areas of human rights, mental health, immigration, poverty prevention, education, and economic development. She currently sits on the boards of the United Way of Greater Toronto, the Canadian Museum for Human Rights, and Jack.org. Ms. Dudtschak is the proud parent of four children, and holds an MBA and the ICD.D designation.

Ms. Dudtschak will join the bank as President on May 1 and Mr. Ranson will continue as CEO until his retirement on June 30. On July 1, she will assume both responsibilities as President and CEO of HomeEquity Bank, reporting to the Board of Directors.

About HomeEquity Bank

HomeEquity Bank is a Schedule 1 Canadian Bank offering a range of reverse mortgage solutions including the flagship CHIP Reverse Mortgage™ product. The company was founded more than 35 years ago to address the financial needs of Canadians who wanted to access the equity of their top asset – their home. The Bank is committed to empowering Canadians aged 55 plus to live the retirement they deserve, in the home they love. HomeEquity Bank is a portfolio company of Ontario Teachers’ Pension Plan Board, a global investor that delivers retirement income for 340,000 current and retired teachers in Ontario. For more information, visit www.chip.ca.

For further information: Jennifer Wasley, Weber Shandwick for HomeEquity Bank, 416 804 3014 or jwasley@webershandwick.com.