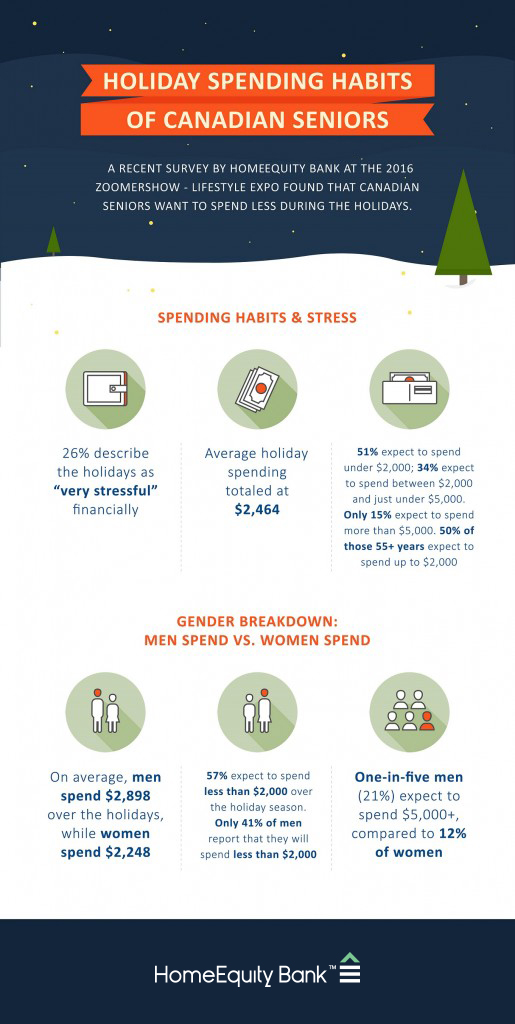

Canadian Seniors Want To Spend Less During The Holidays

TORONTO, December 21, 2016, - The holidays may not necessarily be a merry time of year for all Canadian seniors according to a recent survey of attendees at the Toronto ZoomerShow, ZoomerMedia’s lifestyle expo for people aged 45 plus. The survey, sponsored by HomeEquity Bank, providers of the CHIP Reverse Mortgage™, found that many seniors overspend during the holiday season. In fact, 26% of respondents described the holidays as financially “very stressful”. A total of 632 Toronto ZoomerShow attendees were surveye

Continue Reading...

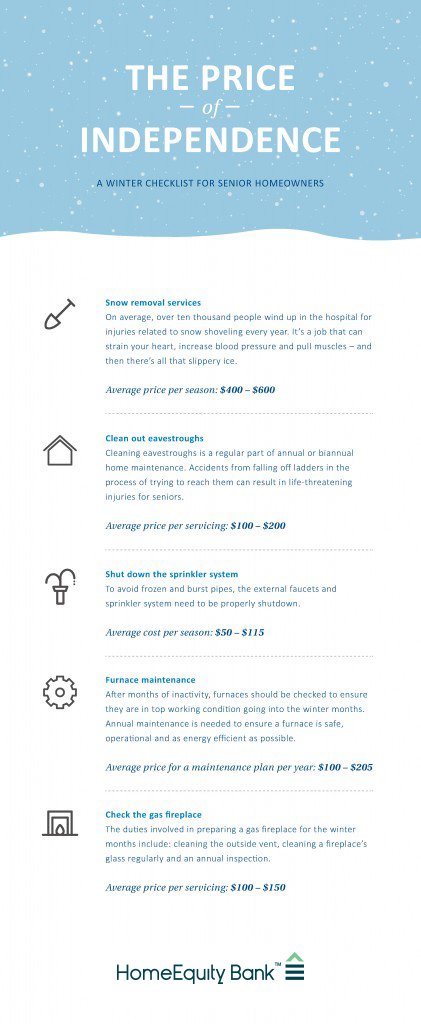

The Price of Independence – A Winter Checklist for Senior Home Owners

Most seniors have a strong desire to remain independent – and live in their own homes. That said, the onset of winter can present a number of challenges to peace of mind. In addition to the high cost of heating a house, there are a number of seasonal maintenance issues that need to be addressed – and paid for. Whether it’s a conversation and encouragement from adult children or a case of careful budgeting, here are some of the services – and attached costs:

Continue Reading...

Reality Gap Threatens The Financial Health Of Canadian Seniors: HomeEquity Bank Research

TORONTO, November 24, 2016, - At a time when Canadian seniors are living longer and healthier lives, their financial fitness requires close attention. Recent research sponsored by HomeEquity Bank, providers of the CHIP Reverse Mortgage™, indicates there is a startling gap between the lifestyle expectations of those Canadians 40+ years and the reality. The study, which looked at the financial health and viability of Canadian seniors, was national in scope and focused on Canadian residents, 40 years or older who own their

Continue Reading...

CARP and HomeEquity announce 3-year “CARP Recommended” partnership

CARP, Canada’s largest non-profit, non-partisan advocacy association for Canadians As We Age, has announced a new 3-year “CARP Recommended” partnership with HomeEquity Bank. HomeEquity is Canada’s only Schedule 1 bank dedicated solely to providing mature Canadian homeowners with the opportunity to enjoy the full value of their home in retirement. CARP will recommend HomeEquity Bank’s product line as a viable and comprehensive solution for Canadians planning for retirement. CARP members in turn, will enjoy su

Continue Reading...

Talking To Aging Parents About Finance

There’s no time like Thanksgiving to start the conversation with your parents about money. Many of us dread this conversation, but it is one that requires planning. Below is a great infographic to help you get the conversation started. We have broken down advice in the form of 10 tips and outlined the top 5 topics to discuss with your parents. It’s time to reach out to your aging parents and offer support, and there’s no better time to start than now!

Continue Reading...