Resolving Complaints

If you have a complaint of any kind, we are committed to resolving it promptly and effectively. We encourage you to follow the process outlined below, to help you get your complaint resolved as soon as possible.

Once we receive your complaint, we will acknowledge receipt and work towards resolving your issue in a timely manner. We will contact you, typically within 7 days, to follow-up accordingly.

We will investigate your complaint and endeavor to provide you with an impartial, objective, and fair resolution to your complaint within 56 days of receipt.

You can obtain, upon request, at any time during the complaint process, an up-to-date status of your complaint.

You have the right to submit your complaint to the Ombudsman for Banking Services and Investments (OBSI), whose contact details are outlined in this brochure, if:

- We are unable to resolve your complaint within the prescribed 56-day period for dealing with complaints

- HomeEquity Bank has provided you with a substantive written response to your complaint.

Step 1: Raise a complaint

For individuals in the pre-mortgage stages:

Contact the Bank’s Sales Representative or Mortgage Specialist you have been dealing with.

If you are already dealing with one of our Sales Representative or Mortgage Specialists, it is best to contact them directly. More than often, your concern can be resolved satisfactorily by talking to the employee that you have already had contact with.

If your complaint is about the Sales Representative or Mortgage Specialists, you can ask to deal with their manager. The sooner you contact the appropriate parties, the sooner they can begin working on a solution for you.

Alternatively, you can contact the Bank in the following ways:

|

Telephone: 1-800-563-2447 Fax: 416-925-9938 Email: Info@heb.ca Online Webform: See Below |

|

Write to: Contact Centre HomeEquity Bank Royal Bank Plaza, South Tower, 200 Bay Street, Suite 3500, Toronto, ON M5J 2J1 |

For clients with existing mortgages

Contact the Bank’s Client Relations Team

|

Telephone: 1-866-331-2447 Fax: 416-925-9938 Email: clientrelations@heb.ca Online Webform: See Below |

|

Write to: Client Relations HomeEquity Bank Royal Bank Plaza, South Tower, 200 Bay Street, Suite 3500, Toronto, ON M5J 2J1 |

Include the following in your correspondence:

- Your name and contact information

- The nature of your complaint

- The resolution you are seeking

Resolving your Complaint

Who are you submitting this complaint for?*

-

I am submitting this complaint for myself.

I am submitting this complaint for myself. -

The consumer has authorized me to submit this complaint for them.

The consumer has authorized me to submit this complaint for them.

Step 2: Ask for your complaint to be escalated to a Designated Complaint Handler

If you are unhappy with how your complaint is progressing or the resolution you received from the employee handling your complaint, ask that employee to escalate your complaint to a ‘Designated Complaint Handler’.

Step 3: Contact the Banks most Senior Designated Complaint Officer

If your complaint has not been resolved to your satisfaction or remains unresolved after following Steps 1 and 2 of our Complaint Process, you may escalate your complaint by contacting our Senior Designated Complaints Officer. However, if your complaint relates specifically to a privacy matter, you can contact our Chief Privacy Officer.

|

Senior Designated Complaints Officer Telephone: 1-855-460-7221 Email: complaintsofficer@homeequitybank.ca Write to: Senior Designated Complaints Officer HomeEquity Bank Royal Bank Plaza, South Tower, 200 Bay Street, Suite 3500, Toronto, ON M5J 2J1 |

|

Chief Privacy Officer Telephone: 1-866-313-2447 Email: privacyofficer@heb.ca Write to: Chief Privacy Officer HomeEquity Bank Royal Bank Plaza, South Tower, 200 Bay Street, Suite 3500, Toronto, ON M5J 2J1 |

External Agencies

If the above steps don’t resolve your complaint, you may consider escalating the matter further to the appropriate external agencies that can further review your complaint.

Ombudsman for Banking Services and Investments (OBSI)

You can contact the Ombudsman for Banking Services and Investments (OBSI), an independent dispute resolution service for consumers with a financial services complaint. You have up to 180 days from receiving our final response or after the prescribed 56-day period for complaint handling expires to submit your complaint to OBSI. More information about OBSI can be found at www.obsi.ca.

You may contact the Ombudsman at:

|

Telephone: 1-888-451-4519 Fax: 1-888-422-2865 Email: ombudsman@obsi.ca |

|

Write To: Ombudsman for Banking Services and Investments 20 Queen Street West, Suite 2400, P.O. Box 8, Toronto, Ontario M5H 3R3 |

The Privacy Commissioner of Canada (OPC)

The mandate of the Office of the Privacy Commissioner of Canada (OPC) includes overseeing compliance with the Personal Information Protection and Electronic Documents Act (PIPEDA), Canada’s private sector privacy law. More information about OPC may be found at www.priv.gc.ca

|

General Inquiries: Toll free: 1-800-282-1376 Phone: (819) 994-5444 TTY: (819) 994-6591 |

For a complaint, you may contact the Office of the Privacy Commissioner by:

|

Writing to: Office of the Privacy Commissioner of Canada 30 Victoria Street Gatineau, Quebec K1A 1H3 |

|

Calling: Toll free: 1-800-282-1376 Phone: (819) 994-5444 TTY: (819) 994-6591 |

Or going online: www.priv.gc.ca/en/report-a-concern/file-a-formal-privacy-complaint

Financial Consumer Agency of Canada (FCAC)

The Financial Consumer Agency of Canada supervises all federally regulated financial institutions, which includes banks, (financial institutions), for compliance with federal consumer protection laws.

Financial institutions are legally required to have a complaint-handling process in place.

If you have a problem with a financial product or service, you may file a complaint with the responsible financial institution directly.

If you are not satisfied with how your complaint has been handled or 56 days has passed since you made your complaint, you can escalate the complaint to the following External Complaints Body: Ombudsman for Banking Services and Investments (OBSI).

If you want to know your rights or need information about the complaint-handling process of a financial institution, you may contact FCAC by online form, mail, or telephone. FCAC uses information from consumer enquiries to support its mandate.

Web site: www.canada.ca/fcac

Phone:

For service in English: 1-866-461-FCAC (3222)

For service in French: 1-866-461-ACFC (2232)

For calls from outside Canada: 613-960-4666

Teletypewriter (TTY): 1-866-914-6097 / 613-947-7771

Video Relay Service: FCAC welcomes Video Relay Service (VRS) calls. You do not need to authorize the relay service operator to communicate with FCAC. Visit https://srvcanadavrs.ca/en/ to learn more.

Mailing address:

Financial Consumer Agency of Canada

427 Laurier Avenue West, 5th Floor

Ottawa ON K1R 7Y2

The Senior Designated Complaints Officer’s Message

HomeEquity Bank is committed to providing excellent customer service to our clients. Our dedicated employees work hard to address concerns brought to our attention and ensure that a satisfactory resolution is reached, or a reasonable explanation is provided before escalating a complaint to the Senior Designated Complaints Officer.

When a mutually acceptable resolution cannot be achieved, the Senior Designated Complaints Officer provides an impartial avenue of appeal for clients with unresolved complaints*. The Senior Designated Complaints Officer is independent and is charged with reviewing customer complaints that remain unresolved after the completion of the first two steps of HomeEquity Bank’s Complaint Handling Process.

The Senior Designated Complaints Officer is not an advocate of any party and is committed to providing an impartial and unbiased review of the complaint to ensure that a fair outcome and reasonable resolution is reached by the Bank and its clients. The Senior Designated Complaints Officer may also make recommendations, where appropriate, to improve HomeEquity Bank’s operations and services to enhance client experiences.

The Year in Review

| 2024 | |

|---|---|

| Total Number of SDE Complaints: | 61 |

| Average number of days taken to deal with the complaint cases: | 71 |

| The number of complaint cases that, in the opinion of the Senior Designated Complaints Officer, were resolved to the satisfaction of the complainant: | 32 |

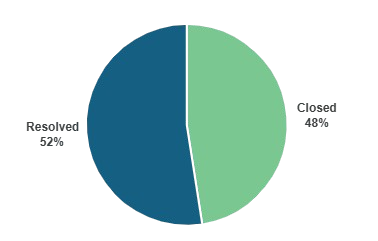

| Case Outcomes | Cases |

|---|---|

| Closed | 29 |

| Resolved | 32 |

2024 Case Outcomes

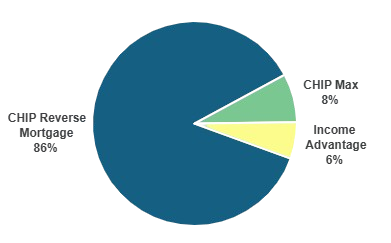

| Cases By Product | Count |

|---|---|

| CHIP Reverse Mortgage | 45 |

| CHIP Max | 4 |

| Income Advantage | 3 |

2024 Cases By Product

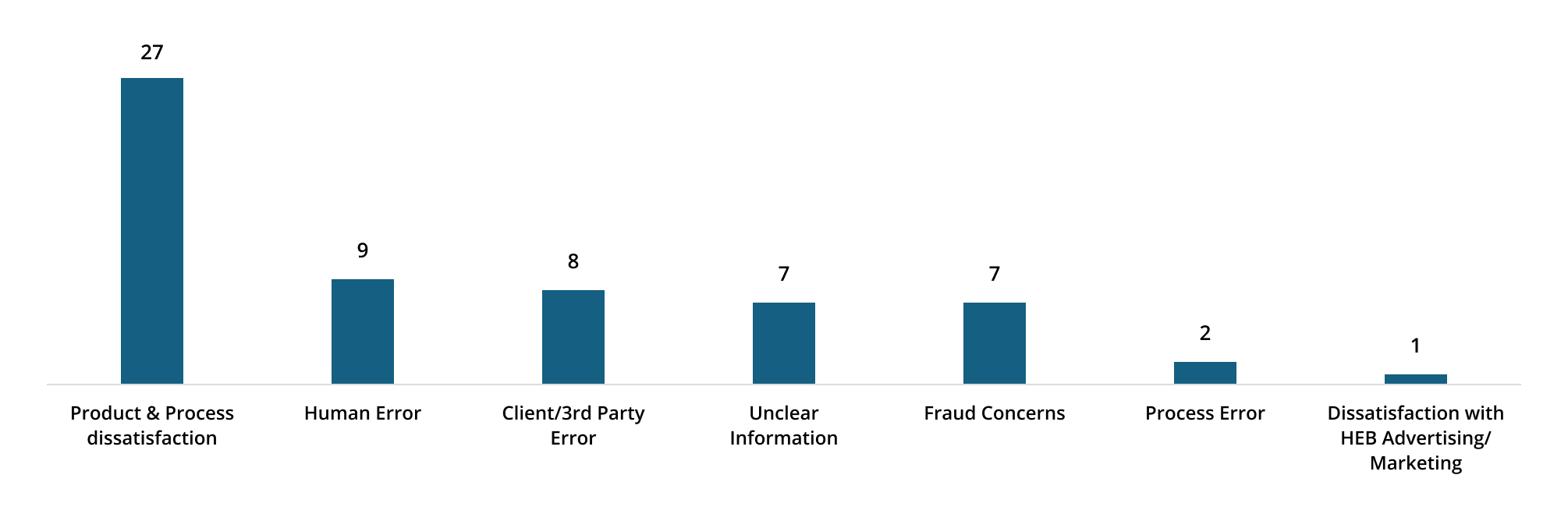

Nature of Complaint Cases

*The Senior Designated Complaints Officer does not adjudicate on complaints related to credit decisions, preferable interest rate requests, mandatory service fees and matters that are in litigation. If a client decides to pursue legal action during the investigation, the Senior Designated Complaints Officer may also cease the investigation. The Senior Designated Complaints Officer does not offer legal or regulatory opinion or advice.